Published: July 6, 2021

Last Updated: July 6, 2021

Introduction: What activity qualifies as scientific research and experimental development (“SRED”) under the Income Tax Act?

What constitutes scientific research and experimental development (“SRED”) under the Income Tax Act, s. 248(1), will depend significantly on not only the possibility of scientific advancement, but also whether the process involved to reach the advancement involved scientific hypothesis, testing, and measurement of results. Section 248(1) of the Income Tax Act defines scientific research and experimental development as “systematic investigation or search that is carried out in a field of science or technology by means of experiment or analysis and that is:

- Basic research, namely, work undertaken for the advancement of scientific knowledge without a specific practical application in view,

- Applied research, namely, work undertaken for the advancement of scientific knowledge with a specific practical application in view, or

- Experimental development, namely, work undertaken for the purpose of achieving technological advancement for the purpose of creating new, or improving existing materials, devices, products or processes, including incremental improvements thereto…”

However, the definition also notably excludes “the commercial production of a new or improved material, device or product or the commercial use of a new or improved process”. Lack of scientific process and documentation may result in an activity’s expenses being disqualified for a tax credit under the scientific research and experimental design incentive program. This was the case in Logix Data Products Inc. v. The Queen, 2021 TCC 36 [Logix Data Products], where the Tax Court of Canada disallowed the taxpayer’s appeal due to lack of scientific process.

The Case of Logix Data Products: The Importance of a systematic and scientific method in SRED activity

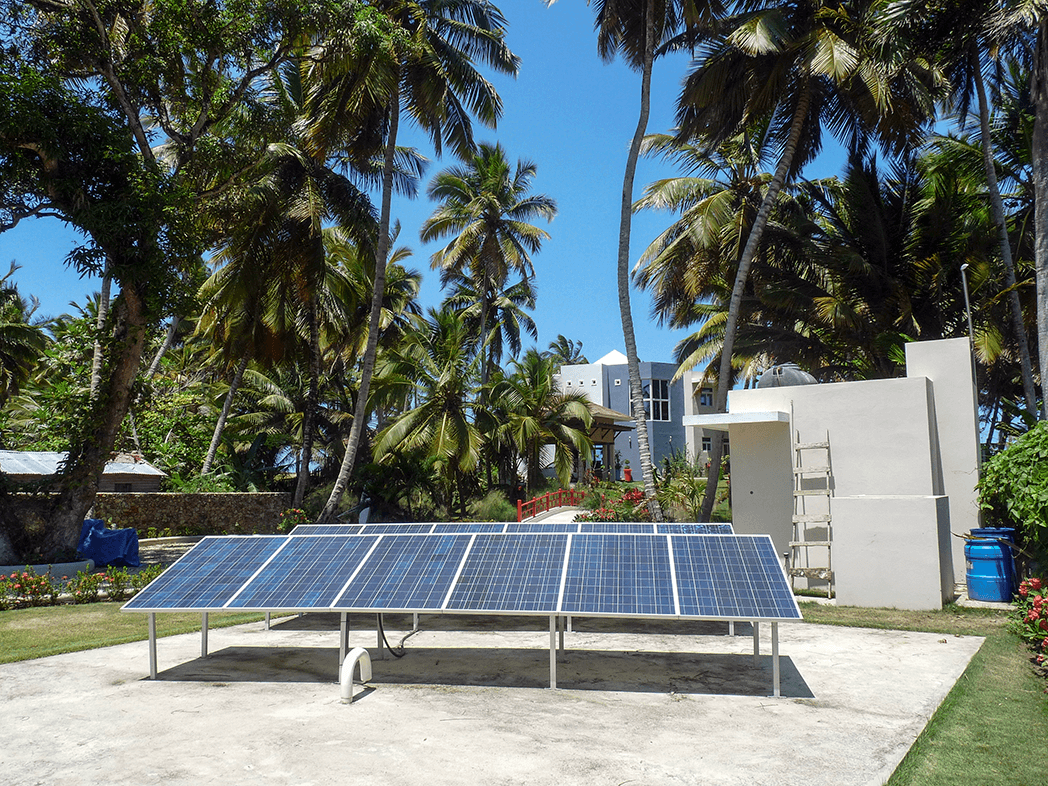

In Logix Data Products, the court dismissed the taxpayer’s appeal that their expenditures qualified as SRED expenses and were thus entitled to research and development tax credits under the Income Tax Act. The SRED in question was the development of a solar panels product which would be attached to roofs and would replace the need for shingles.

While the CRA had accepted Logix’s expenditures to test the development of fabricating a solar panel with PVC rather than glass in the previous 2011 and 2012 taxation years, they challenged the work done in 2013 to create solar panel shingles. The purpose of the research activity was to develop a solar panel shingle which would be able to replace regular roof shingles. This would allow a roof to forgo bulky utility-grade solar panels and remain aesthetically pleasing.

In assessing whether the shingle solar panels could be classified as SRED as defined in the Income Tax Act, the Court applied 5 criteria identified by the Federal Court of Appeal in CW Agencies Inc. v Canada, 2001 FCA 393: technological risk or uncertainty; hypotheses developed to reduce or eliminate the technological uncertainty; scientific method applied including formulation, testing, and modification of hypotheses; technological advancement; and detailed record of the testing of hypotheses and results. While the court noted that the failure of one of the criteria will not be fatal to the classification of the activity to qualify as SRED, they also noted that three of the criteria are mandatory to be met if an activity is to qualify as SRED. The three criteria were: the activity results in technological advancement; the research efforts are systematic; and that the activity involves technological risk or uncertainty which cannot be removed by routine engineering or standard procedures.

When deciding whether the activity involved technological uncertainty or risk, the court found that there was not sufficient evidence to show the existence of uncertainty or risk. The evidence presented in front of the court by the taxpayer’s Canadian tax litigation lawyer did not show that persons knowledgeable in the field of solar energy would characterize the activity as involving technological uncertainty. The appellant also did not significantly involve any experts in solar energy, mechanical engineering, electrical engineering, or solar panel production during the development of the product. In addition, there was not sufficient evidence presented to the court about the state of the relevant knowledge in the field of solar energy pertaining to the potential for technological advancement.

The second criterion the court discussed was whether the research efforts were systematic. Systematic research efforts involve formulation of hypotheses, methodically testing, observing the results, and adapting the hypotheses accordingly. The Court ruled that Logix Data Products Inc. did not present sufficient evidence that developing the solar panel shingle product involved following a scientific method. The test documents lacked hypotheses and the test result records failed to describe the product detail sufficiently. On the criterion of technological uncertainty and scientific method, the Tax Court dismissed the taxpayer’s appeal and did not consider the third criterion of whether the shingle solar panels constituted technological advancement.

Pro Tax Tip: Scientific Research & Experimental Development Tax Credit

Lack of scientific process and documentation may result in an activity’s expenses being disqualified for a tax credit under the scientific research and experimental design incentive program. An activity in which you plan to claim a SRED tax credit should follow a scientific method and track hypotheses testing and results. In addition, experts knowledgeable in the field should be significantly involved in the research activity. When submitting an SRED claim or when planning to appeal a CRA decision, you should seek professional advice from an experienced Canadian tax litigation lawyer to clarify the Income Tax Act and relevant case law on your SRED tax issue.

Disclaimer:

"This article provides information of a general nature only. It is only current at the posting date. It is not updated and it may no longer be current. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in the articles. If you have specific legal questions you should consult a lawyer."

Frequently Asked Questions

The scientific research and experimental design (“SRED”) incentive program provides tax incentives to perform eligible SRED work in Canada. The tax incentive is related to the SRED activity’s qualified expenditures and allows the taxpayer to reduce tax otherwise payable in the current taxation year or in future taxation years.

To claim a scientific research and experimental design (“SRED”) tax credit, you should be prepared to demonstrate that the expenses relate to scientific research and experimental design that satisfies 5 criteria. These criteria are: the existence of technological risk or uncertainty; hypotheses developed to reduce or eliminate the technological uncertainty; scientific method applied including formulation, testing, and modification of hypotheses; technological advancement; and detailed record of the testing of hypotheses and results.

Most expenditures incurred in respect of scientific research and experimental development (“SRED”) that is carried on in Canada will qualify for the scientific research and experimental design tax credit. Exceptions include: expenditures made for capital or lease costs; expenditures paid to non-arm’s length parties; and expense relating to SRED which has or will receive government assistance in that taxation year.